Xdemvy is the first treatment that directly targets the mites involved in the Demodex blepharitis. It is expected to be available by the end of August 2023 and will have a list price of $1,850 per prescription.

Xdemvy is the first treatment that directly targets the mites involved in the Demodex blepharitis. It is expected to be available by the end of August 2023 and will have a list price of $1,850 per prescription.

If approved, Ofev would be the first approved treatment for children and adolescents with fibrosing interstitial lung disease. A decision is expected in the fourth quarter of this year.

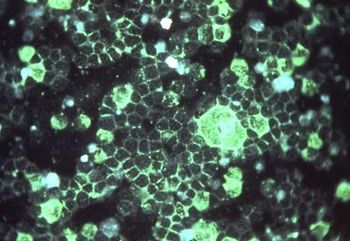

Ycanth, a topical treatment for molluscum contagiosum, will be available in September. Pricing information has not yet been released.

Sara Izadi, Pharm.D., of Capital Rx, talks about Rx Reverse, an integrated clinical program designed to help members reverse diabetes and fight obesity.

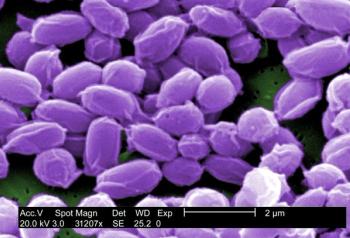

Emergent BioSolutions has been providing the Cyfendus vaccine to the U.S. Department of Health and Human Services since 2019, under a pre-emergency use authorization status.

Vanflyta is the first FLT3 inhibitor approved to treat patients with newly diagnosed acute myeloid leukemia across three phases of treatment. It has a list price of $199,290 annually.

The FTC says that prior statements and studies about the PBM industry no longer reflect current market realities.

An analysis by Biosimilars Council has found that the reference product Lantus accounts for 54% of new prescriptions and is 78% of total market volume but demand for the unbranded interchangeable insulin glargine is increasing.

The newly formed Peterson Health Technology Institute was launched with $50 million to analyze clinical benefits and economic impact of new health technologies.

About 36% of Medicare Part D enrollees will benefit from the Inflation Reduction Act’s out-of-pocket caps for prescription drugs, which will go into effect in 2025.

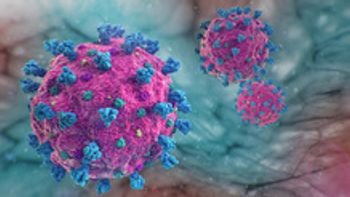

Beyfortus will be available ahead of the upcoming 2023-2024 RSV season. A price has not yet been set.

Most private health insurance plans are required to cover vaccines for COVID-19 without patient cost-sharing.

Donanemab slowed cognitive decline by about 35% for patients at the earliest stages of Alzheimer’s disease.

In the short term, two gene therapies now under review at the FDA — lovo-cel and exa-cel — can reduce the frequency of painful crises in patients with severe sickle cell disease.

KFF analysis has found that 10 drugs account for 22% of all Medicare Part D spending in 2021.

Prime Therapeutics’ analysis of claims data suggests patients require support to ensure continued use and lifestyle modification.

Opill will be available in stores and online in the first quarter of 2024.

A 30-day supply of Brenzavvy is available from Cost Plus Drugs for $47.85.

Beginning in January 2024, if GoodRx shows a lower CVS price than a member’s plan price, that lower price will automatically be given.

About half of Navitus’ commercial clients saw a drug spend decrease compared with 2021.

Takeda indicated that it could not address issues related to aspects of data collection within the current BLA review cycle.

Governor Phil Murphy has signed three pieces of legislation that would require PBMs to use prescription drug rebates to lower premiums and out-of-pocket costs for consumers and prevent the practice of spread pricing.

The label for Leqvio has also been updated to remove four adverse events based on recent safety data.

Express Scripts will also add Sandoz’s unbranded version of adalimumab to its National Preferred Formulary. The Humira biosimilar Amjevita was added previously.

Medicare will cover Alzheimer’s drugs with full approval, including Leqembi — if the physician and patient participate in a real-world registry trial to gather additional data.

There is a risk the inhaler wouldn’t provide the right dose.