Manufacturers Adopt ‘No Cure, No Pay’ Pricing for Hemophilia Gene Therapy

BioMarin Pharmaceutical and CSL Behring are offering valu\ed-based contracts for their hemophilia gene therapies.

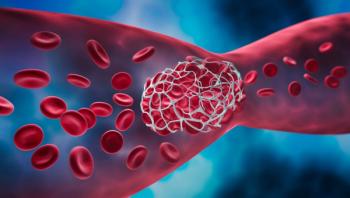

With two gene therapies now FDA approved for hemophilia A and B, manufacturers of these products need a different type of authorization to see these agents put into action: payer approval.

These therapies each cost millions of dollars, and although each offers the potential of a cure and an end to lifetime costs of hemophilia treatment, payers want to be sure they are getting value for the dollar.

Failed treatments mean patients must return to the hemophilia therapies they were on previously, be it on-demand or prophylaxis bleeding control products, potentially leaving payers on the hook for the cost of multimillion-dollar gene therapies that did not work.

Hemgenix (etranacogene dezaparvovec) gene therapy for hemophilia B, has a price tag of $3.5 million, and Roctavian (valoctocogene roxaparvovec) for hemophilia A, costs $2.9 million.

Outcomes-based therapy, also known as precision reimbursement or “no cure, no pay,” has been discussed for years as a way to ease the financial risk that payers must bear, but it has failed to gain widespread traction, for a number of reasons.

The extraordinarily high price of gene therapy, coupled with the lack of clinical data on durable outcomes and the limited patient population for these therapies, appears to have brought about a sea change.

BioMarin Pharmaceutical, the developer of Roctavian, has announced intentions of reimbursing up to 100% of the cost should patients fail to respond or cease to respond in the first four years after administration.

Meanwhile, CSL Behring, the developer of Hemgenix, told Managed Healthcare Executive it is negotiating with payers to offer a similar deal.

“CSL Behring is having conversations about value-based arrangements with commercial and government payers who are interested in this model,” a spokesperson for the company said. “Under this value-based arrangement, we will offer a substantial rebate to the payers if patients return to using prophylactic factor IX during the first 3 1/2 years following infusion.”

As Roctavian and Hemgenix leave the starting gate, such arrangements offer substantial hope of improved access for patients who are appropriate for these treatments.

These gene therapies, which counter genetic irregularities that prevent patients from producing sufficient clotting factor, rely on an adeno-associated viral vector for delivery. However, tests are yet to be perfected for determining which patients are ideally suited for this therapy.

One of the drawbacks of outcomes-based therapy is that payers may not be equipped for the level of individual patient tracking and outcomes analysis needed to evaluate for response, although the high cost of gene therapy may make this imperative.

“With traditional drug reimbursement frameworks, payment is based on an assumed randomized controlled trial projection of real-world effectiveness. The clinical benefit realized for patients is not usually ascertained (after product launch) by collection of real-world data,” wrote lead author

Hans-Georg Eichler, M.D., M.Sc., of Medical University of Vienna, and his colleagues in a recent

One of the main questions in the “one-and-done” promise made by the gene therapy makers is how long will with their effects — their “durability.” The FDA approved Roctavian in June 2023 based on a three-year, phase 3 clinical trial results. The agency approved Hemgenix in November 2022 based on results of the phase 3 HOPE-B trial, whose primary end point was the 18-month annualized bleeding rate.

Newsletter

Get the latest industry news, event updates, and more from Managed healthcare Executive.